An Unbiased View of Mileage Tracker

Table of ContentsThe smart Trick of Mileage Tracker That Nobody is Talking AboutMileage Tracker Fundamentals ExplainedThe 2-Minute Rule for Mileage TrackerNot known Details About Mileage Tracker Some Of Mileage TrackerOur Mileage Tracker Statements

A web-based organizer needs to be able to give you a quite exact estimate of mileage for the trip in question. While it may look like an arduous job, the benefits of maintaining a vehicle gas mileage log are remarkable. Once you get into the routine of tracking your gas mileage, it will certainly end up being second nature to you.

Ready to start your efficiency journey? Have a look at our collection of notebooks!.?. !! Portage Notebooks is located in Northeast Ohio and has been developing specialist notebooks for media, legislation enforcement, and services for over fifty years. Our notebooks are made making use of the greatest high quality products. If you have an interest in discovering more regarding efficiency, time monitoring, or note pad organization tips, visit our blog. If you have any questions, don't be reluctant to connect - email us at!.

For small company proprietors, tracking mileage can be a tiresome however important job, specifically when it pertains to optimizing tax obligation deductions and managing overhead. The days of manually videotaping gas mileage in a paper log are fading, as digital mileage logs have actually made the process a lot more effective, precise, and convenient.

The Single Strategy To Use For Mileage Tracker

Among one of the most significant advantages of utilizing an electronic mileage log is the time it saves. With automation at its core, electronic tools can track your trips without needing manual input for each journey you take. Digital mileage logs take advantage of general practitioner modern technology to immediately track the range took a trip, categorize the trip (e.g., company or personal), and create comprehensive records.

The app does all the help you. Time-saving: Save hours of hands-on information entrance and stay clear of human mistakes by automating your gas mileage logging procedure. Real-time tracking: Promptly track your miles and create reports without waiting till completion of the week or month to log trips. For local business owners, where time is cash, using a digital gas mileage log can considerably simplify daily procedures and cost-free up even more time to focus on expanding business.

Some company owners are uncertain concerning the advantages of tracking their driving with a gas mileage application. The gas mileage tracker is a great tool that provides several advantages. Download it here to read more. Basically, tracking gas mileage throughout Visit Your URL service travel will aid to improve your gas performance. It can also aid decrease vehicle deterioration.

Mileage Tracker - Truths

This article will reveal the benefits related to leveraging a gas mileage tracker. If you run a delivery business, there is a high opportunity of spending long hours when traveling daily. Local business owner commonly discover it tough to track the ranges they cover with their vehicles since they have a great deal to think of.

In that instance, it means you have all the possibility to improve that facet of your company. When you use a mileage tracker, you'll have the ability to record your prices much better. This assists your total monetary records. You would certainly be able to reduce your expenses in certain areas like taxes, insurance, hop over to these guys and automobile wear and tear.

Gas mileage monitoring plays a large role in the lives of many chauffeurs, staff members and company decision makers. What does gas mileage monitoring indicate? And what makes a gas mileage tracker app the best gas mileage tracker application?

The Facts About Mileage Tracker Uncovered

Gas mileage monitoring, or mileage capture, is the recording of the miles your drive for organization. There are a few factors to do so. Prior to the TCJA, W-2 employees would track miles for tax obligation deduction. Nevertheless, this is no longer an option. Many full time staff members or contract employees record their mileage for repayment functions.

It is essential to keep in mind that, while the gadget utilizes general practitioners and movement sensor capabilities of the phone, they aren't sharing places with companies in real time - mileage tracker. This isn't a monitoring initiative, but a more hassle-free way to catch the company journeys traveled precisely. A totally free gas mileage capture app will certainly be difficult ahead by

The Ultimate Guide To Mileage Tracker

Mileage apps for find more info private vehicle drivers can cost anywhere from $3 to $30 a month. Our team has years of experience with gas mileage capture. One point we do not use is a single-user gas mileage application. We comprehend there are a great deal of employees available that need an application to track their mileage for tax and reimbursement purposes.

There are a considerable number of advantages to making use of a mileage tracker. For companies, it's internal revenue service conformity, raised exposure, reduced mileage fraud, lowered management. For professionals, it's mostly regarding tax obligation deduction. Let's explore these benefits additionally, beginning with among one of the most crucial factors to carry out a gas mileage monitoring app: internal revenue service conformity.

Cost reimbursement fraudulence accounts for 17% of company expenditure scams. With an automated gas mileage monitoring app, firms receive GPS-verified gas mileage logs from their staff members.

Mileage Tracker - Questions

Automating mileage tracking boosts efficiency for those in the field and those busy loading out the logs. With a mileage app, logs can conveniently be submitted for repayment and complimentary up the administrative work of confirming all worker mileage logs.

Once more, service providers generally use business gas mileage trackers to keep track of their gas mileage for tax obligation deductions. What makes the finest mileage tracker app?

Jennifer Grey Then & Now!

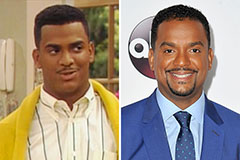

Jennifer Grey Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!